Mortgage Elimination Program

What is the Best way to pay your mortgage?

SELECT YOUR ANSWER.

A. BI-MONTHLY

B. EXTRA PAYMENTS WHEN POSSIBLE

C. REFI FOR A LOWER INTEREST RATE

D. REFI FOR A SHORTER TERM

E. NONE OF THE ABOVE

* MOST PEOPLE THINK THAT BI-MONTHLY OR MAKING EXTRA PRINCIPLE PAYMENTS IS THE BEST WAY.

* OTHERS BELIEVE THAT REFINANCING FOR A LOWER INTEREST RATE OR SHORTER TERM IS BEST OR A COMBINATION OF ALL FOUR.

* THE PROBLEM IS THAT YOU ARE STILL PAYING A CONVENTIONAL LOAN AND THE INTEREST IS FRONT LOADED AGAINST YOU.

* ALSO THE MONEY YOU PAY TOWARD THE MORTGAGE IS NOT ACCESSIBLE UNLESS YOU REFI AGAIN AND AGAIN AND AGAIN. THERE IS A BETTER WAY TO PAY OFF YOUR MORTGAGE!

FIX YOUR CASH FLOW

Best

Way To Pay Your Mortgage

And

Still Have Acess to Your Equity!

Loan Amount is your Current none HELOC mortgage FMV x 80%.

Interest Rate: 5% to 8% depending on Prime.

Draw Period and Repayment Period is going to be 10 years!

Additional Principlal payments are total Yearly income, Tax Returns....etc all divided by 12 months...etc. for the monthly interest only payment calculation.

Expenses, Fees, Closing Cost and Yearly Bills, Property taxes, Draws and...all expenses divided by 12 months.

HELOC Payoff Calculator

WHAT WE OFFER 2 PLANS

PLAN A. 1,200.00

COMPREHENSIVE STEP BY STEP GUIDE TO PAY OFF YOUR MORTGAGE IN AS LITTLE AS 10 YEARS OR LESS AND STILL HAVE ACCESS TO YOUR EQUITY.

STEP 1. QUALIFICATION

STEP 2. EDUCATION.

STEP3. FINDING THE RIGHT LENDER.

STEP 4. USING OUR HELOC CALCULATOR.

PLAN B. 3500.00 FOR THOSE THAT NEED PERSONAL 1 ON 1 HELP. WE WALK YOU THROUGH THE STEPS.

Pre-Qualify Application

Contact the MyEcon IBA that refered you.

(678) 619-4929

Bonus Information

WHAT IS THE BEST WAY TO INVEST YOUR MONEY?

Select your answer.

A. Stocks

B. Mutual Funds

C. IRAs/401Ks

D. Bonds

E. None of the above

max Fund a correctly structured IUL.

TECHNICALY AN IUL IS NOT AN INVESTMENT.

IT IS AN INSURANCE POLICY THAT GROWS CASH VALUE WHEN DESIGNED FOR CV GROWTH.

THE BEST DESIGN GETS MOST OF YOUR PLANNED PREMIUM TO THE CV COLUMN BEFORE ANY CREDITIED INTEREST IS APPLIED.

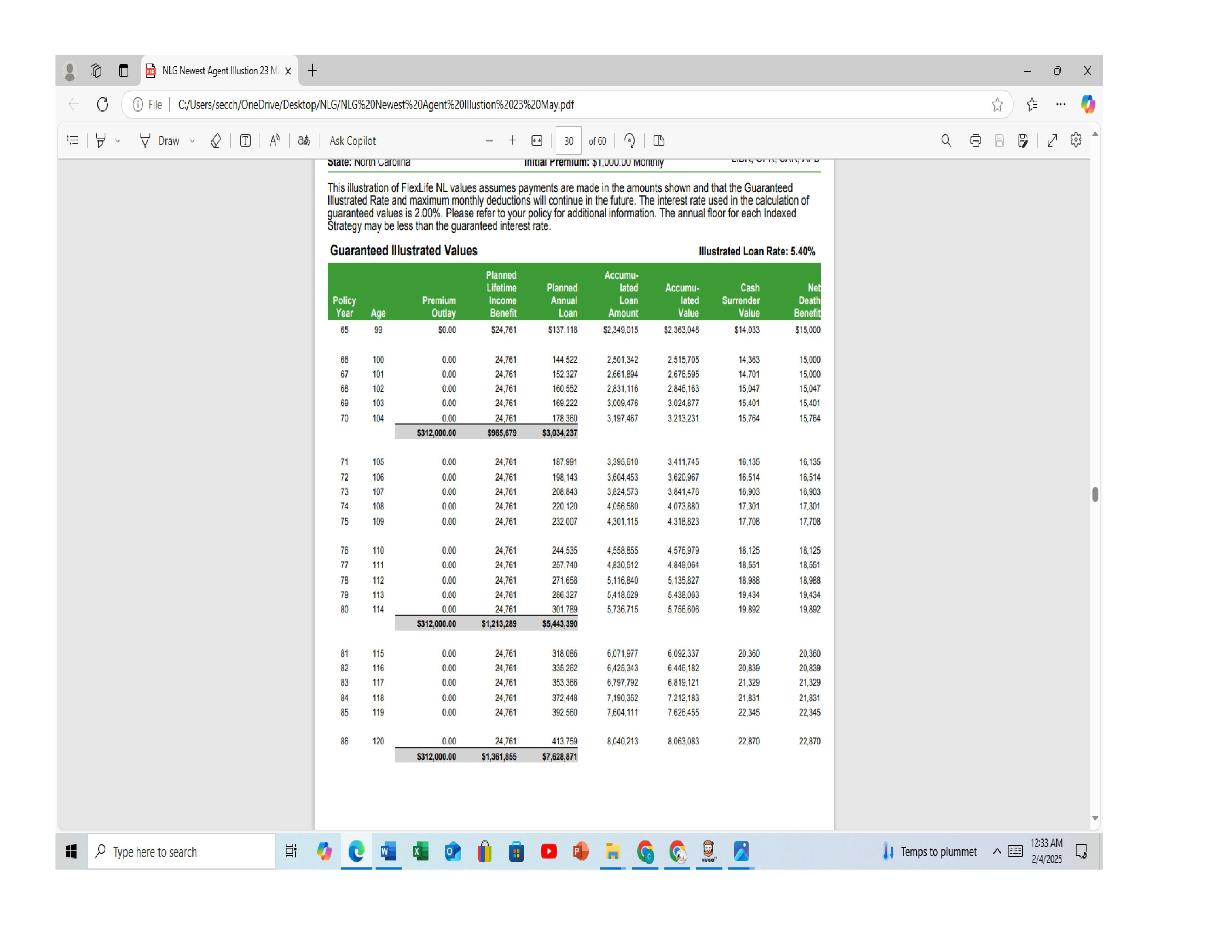

THE BEST DESIGN alsoHAS GUARANTEED INCOME IN THE GUARANTEED COLUMN.

IF YOU ARE LOOKING TO INCREASE YOUR CASH FLOW, BUILD WEALTH,

and

CREATE A FLOOD OF TAX-FREE RETIREMENT INCOME or LEAVE BEHIND A LEGACY, LOOK NO FURTHER.

INFINITE BANKING

USING MY IUL DESIGN YOU CAN BoRROW AGAINST THE CASH VALUE. IF YOU USE THE BALANCE SHEET RIDER YOU WILL BE ABLE TO BoRROW AGAINST 100% OF THE CASH VALUE year 1. However i recommend paying back the loans and interest each year!